Input Defaults

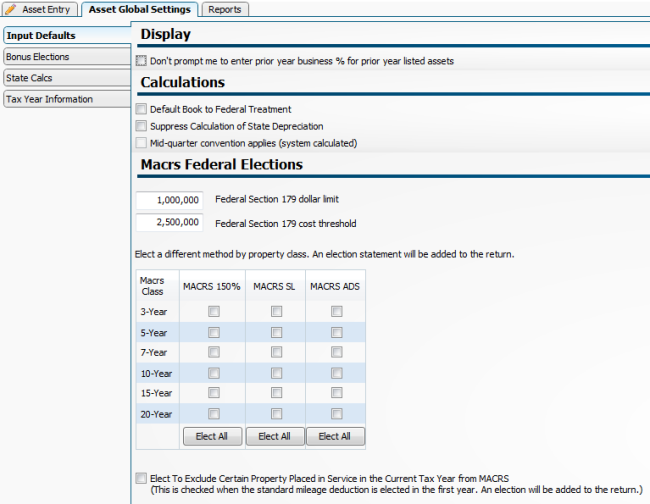

The Input Defaults tab (under Asset Global Settings) allows you to setup defaults on a client by client basis.

Input Defaults tab (Asset Global Settings)

Display

Select the check box to disable the automatic prompt regarding prior year business % when entering prior year listed assets.

Calculations

Default Book to Federal Treatment- select the check box to have book depreciation default to Federal treatment.

Select the check box to suppress the calculation of state depreciation (for example if the state is a non-tax state). The mid-quarter convention box is non-editable and will be checked if mid-quarter convention applies.

MACRS Federal Elections

The Federal Section 179 dollar limit and cost threshold: Program updates will automatically keep these limits current with Federal legislation but you can override the system defaults on a per return basis as desired.

MACRS Elections for 150%, SL or ADS: Select from one of these elections per recovery period or class to default all new assets with the selected method.

See Also: